You Don't Know You're Living in the AI Meme Bubble (But You Are)

TL;DR: AI hype is absurd, money moves in confusing circles, and memes are now a valid form of financial analysis. Enjoy the chaos, learn the memes, and maybe just maybe let AI write your next blog post 😉. Now grab your chai and get scrolling.

Introduction

Welcome to 2025, where money moves faster than your cousin’s WhatsApp forwards, and your notifications scream louder than a Mumbai local at peak hour. The tech landscape is swimming in AI hype, and two schools of wealth creation dominate: one is the trillion-dollar mutual back-slap between NVIDIA, OpenAI, and Oracle, the other is Apple quietly giving away hundreds of billions to shareholders, like an overly generous uncle at Diwali.

We’re here to unpack both, sprinkle in some history (Cisco, anyone?)

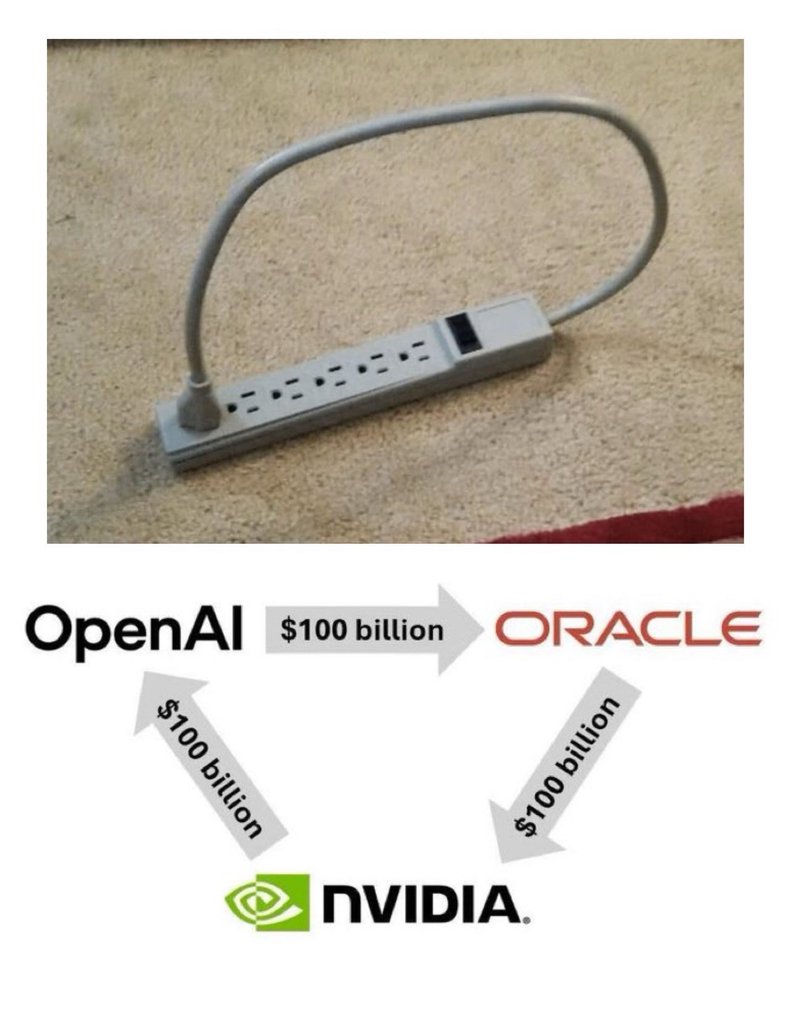

The Trillion-Dollar Feedback Loop — NVIDIA, OpenAI & Oracle

At the core of the AI boom is a money-ception scenario: NVIDIA invests in OpenAI, OpenAI buys compute from Oracle, Oracle buys NVIDIA hardware, and the cycle continues. Indian Redditors might call this the “ek hi ladoo sabke liye” scheme — everyone thinks they’re winning, but whose hand is it really in?

NVIDIA’s $100 Billion “Smartest Investment Ever” in OpenAI

NVIDIA is basically saying: “We’ll give OpenAI $100B if you promise to buy our chips, maybe someday.” Finance folks call it vendor financing on steroids. In Indian-speak, it’s like lending your friend money to buy a PS5 and being like, “Also, can you pay me back in six years and throw in some ladoos?”

OpenAI’s $300 Billion Compute Contract with Oracle

OpenAI inks a contract with Oracle for cloud services requiring 4.5 gigawatts of power. Yes, gigawatts. Reddit jokes: “Yeh log Netflix binge karte karte server ko roast kar rahe hain kya?” — they’re basically running the AI equivalent of streaming the entire Bollywood library in one contract.

Project Stargate: Data Centers Galore

$500B later, Project Stargate is building 10 GW of AI data centers. Five sites, 25,000+ jobs, millions of NVIDIA GPUs. Indian Twitter would say: “Yeh toh Mumbai local train ka crowd hai, but in servers.” Massive, chaotic, and thrilling to watch from afar.

Circular Financing, a.k.a The Rasode Moment

Analysts call it “circular financing,” we call it: “Rasode mein kaun tha? NVIDIA!”. Money goes from NVIDIA → OpenAI → Oracle → NVIDIA. Strategically brilliant, socially confusing, and slightly alarming if you care about antitrust regulations.

Apple vs. Tesla — The Tale of Two Philosophies

While AI giants play mutual investment Tetris, Apple and Tesla showcase two very different philosophies.

Apple: Buybacks Like It’s Diwali

Apple spends hundreds of billions repurchasing shares. EPS goes up, shareholders smile. Critics: “Great, now can someone buy innovation instead of just stock?” Apple’s strategy is like giving out mithai to impress neighbors while the factory floor gathers dust.

Tesla: Reinvest or Die

Tesla keeps all earnings inside the company, funding R&D, EVs, AI, and humanoid robots. The Indian analogy? “Beta, no pocket money for you, we’re buying land instead.” Every rupee is reinvested for growth, making Elon Musk the ultimate strict parent of the tech world.

Generative AI: Meme-Infused Profit Ambitions

Meanwhile, generative AI startups are busy flexing on LinkedIn: “We built a bot that writes essays, jingles, and samosa recipes simultaneously.” The reality: 95% of projects haven’t made profits yet. India-speak: “Boss, ye AI ka show toh promo phase mein hai, ab original series dekhne ka time hai.”

Echoes of the Dot-Com Bubble

History loves a good meme. Cisco’s vendor financing strategy mirrors NVIDIA today: huge hype, circular money flow, and eventual lessons in humility. Indian Twitter: “Kabhi khushi, kabhi gham — stock prices edition.” Even if AI changes the world, valuations can still collapse faster than your uncle’s Wi-Fi during a Zoom call.

Hype Cycle Dynamics

Generative AI is entering the Trough of Disillusionment. Investors are beginning to separate the meme from the method. The winners will be those who can turn massive infrastructure into actual profit, not just Instagram-worthy announcements.

Meme-Driven Investor Culture

From stock-research WhatsApp groups to Reddit threads, AI has become a cultural flex. Memes like “GPT, write my CV so I can get a $10k/month remote job without moving out of my parent’s room” aren’t just funny—they’re how the Indian tech community processes chaos.

Strategic Outlook

Two dominant forms of wealth creation:

- NVIDIA-OpenAI-Oracle loop: audacious, interdependent, high risk — like playing Ludo with relatives who never follow the rules.

- Apple’s financial engineering: cash back to shareholders while innovation sleeps — like giving your dog treats while ignoring the torn sofa.

Tesla reinvests for future growth, a stark contrast to Apple’s comfort zone. Meanwhile, the AI industrial complex must convert massive infrastructure into tangible profits or face a public facepalm moment of epic proportions.

Meme summary: “Ab chai peelo, popcorn nikalo, aur dekhte hain kiska time aa raha hai” watch closely, it’s going to be entertaining. And somewhere, Larry Ellison is probably laughing at your meme about GPUs.